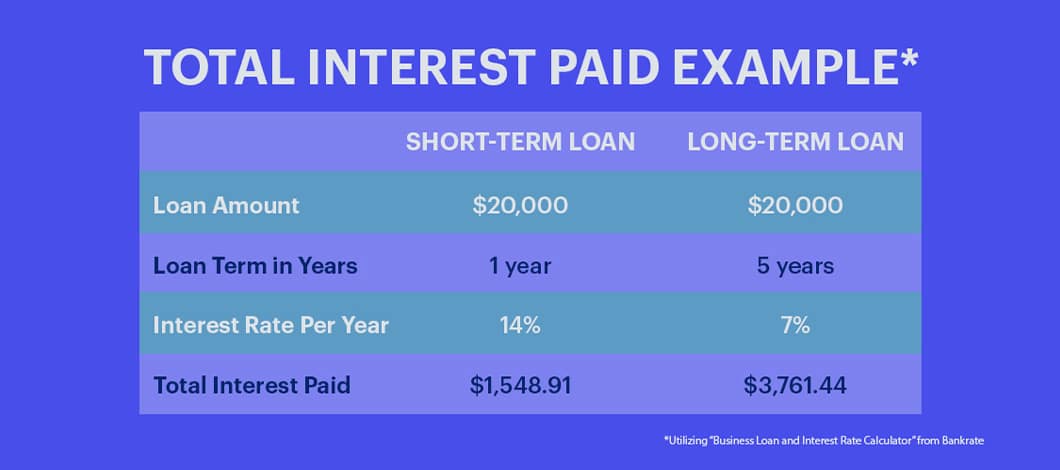

Your payments continue to be the same, along with your cost wouldn’t change over the term of financing

Get a hold of an easier way so you can Acquire

You reside a strong investment. If you have an upcoming large costs or are renovating the most recent home, SouthPoint makes it possible to make use of this new collateral of your home.

Domestic Security Credit line

A house security personal line of credit (HELOC) are a flexible and you may sensible treatment for protection high, ongoing otherwise unforeseen expenditures, instance home improvements and you may debt consolidation reduction.

- Only step 3.99% APR* to own 12 months, typical rate as low as 5.75% APR*. Shortly after one year, speed will vary out-of 5.75% % APR*.

- Restrict Closing Price of $299*

- 24-Hours Availableness; Play with Finance for Things

- No Annual Commission

- 10-season draw months, upcoming take-up in order to a decade to pay off any kept balance

- Interest is generally tax-deductible (check with your taxation advisor)

- You would like a lowered price option than other financing alternatives

- You want lingering usage of dollars, including to possess problems otherwise college tuition

Home Equity Variable Speed

A house equity loan, also known as another home loan, enables you to borrow secured on this new equity you collected in your home during your deposit, mortgage repayments and increased domestic well worth.

When you take aside a home collateral financing, the rate is restricted, and you obtain the profit you to lump sum payment.

Having said that, a house security line of credit (HELOC) typically has a variable interest-even if SouthPoint offers the choice to secure at low fixed speed. Including, good HELOC allows you to withdraw funds if you want him or her, as much as the credit limit, from inside the https://paydayloansconnecticut.com/bethlehem-village/ title of one’s loan.

Your loan-to-well worth proportion (LTV) is a portion that suggests how much security you have got when you look at the your residence. LTV can be used to simply help dictate costs having home collateral funds and you will personal lines of credit.

Home collateral fund and you may lines of credit try covered from the property value your residence, and therefore otherwise build costs you could potentially face serious consequences for example property foreclosure and you will borrowing from the bank wreck similar to if you don’t create your mortgage payments.

Although not, after you use from your own home guarantee sensibly, you could potentially make the most of straight down rates plus beneficial words than just most other financing brands, along with potential income tax professionals. Domestic guarantee can be a powerful way to money huge plans, particularly home improvement ideas that put value to your house and enhance your quality of life.

In a nutshell in order to method home equity fund and you can traces since you create any other type out of credit tool: you should have a real reason for borrowing from the bank and you will an idea having exactly how possible repay it.

That have a property security credit line (HELOC) out of SouthPoint, you could obtain to 90% of the home’s collateral because a line of credit. It is rather convenient, also it functions similarly to credit cards. Borrow what you want, when it’s needed, until you reach finally your credit limit.

Withdrawing money for the mark several months: Here is the lay amount of time (always ten years) as possible use from your own credit line. You could potentially offer their draw several months, according to your own credit condition.

Paying off during the mark months: In mark several months, you can make the minimum costs on which you borrowed, although not i encourage expenses much more to minimize the bill.

Installment period: Since mark several months concludes, you’ll not be able to withdraw fund. So far, your loan goes into new repayment several months, in case the payments will include one another prominent and interest. These types of repayments is greater than the eye-only money you made into the draw several months.

*Annual percentage rate Apr. As low as 3.99% Apr getting 1 year out-of closure big date. After one year speed will vary anywhere between 5.75% % Apr centered on the creditworthiness. For new HELOCs simply. Need to take care of a balance greater than zero towards the HELOC for the original twelve (12) days If you can’t follow so it standard the eye rates in your HELOC increase with the changeable rates mentioned into Family Guarantee Line Arrangement and Revelation statement though the fresh new 12 (12) days are not right up but really. $299 settlement costs may not be found in most of the claims and you will does not include price of assessment. Have to bring insurance policies that obtains this tactic. Closing costs varies from $0.00 so you can $step one,. Origination percentage out of $50. Query a loan associate having information.

No Comments