There are many different financing products getting prospective homeowners, with a few tailored particularly to certain version of homebuyers

Mortgage Book

Since you take care to examine an educated lenders, it is best if you know up to you could potentially concerning application process, the various loan providers, and your certain loan alternatives. Continue reading for additional information on home loan products and the way they work.

Just how do Mortgage loans Performs?

When consumers take out a home loan, they acquire a certain number of money and you may agree to pay they straight back throughout the years. Generally speaking, buyers have to have a deposit buying a home, and they’re going to be recharged mortgage loan on the mortgage that is according to an apr (APR).

The loan loan is supported by the newest collateral at your home these are generally to purchase, thus consumers is clean out their property so you’re able to property foreclosure whenever they falter to keep up with their monthly obligations. That said, residents including generate guarantee within property because they build money through the years, and they’ll individual their residence outright because the finally mortgage payment is made.

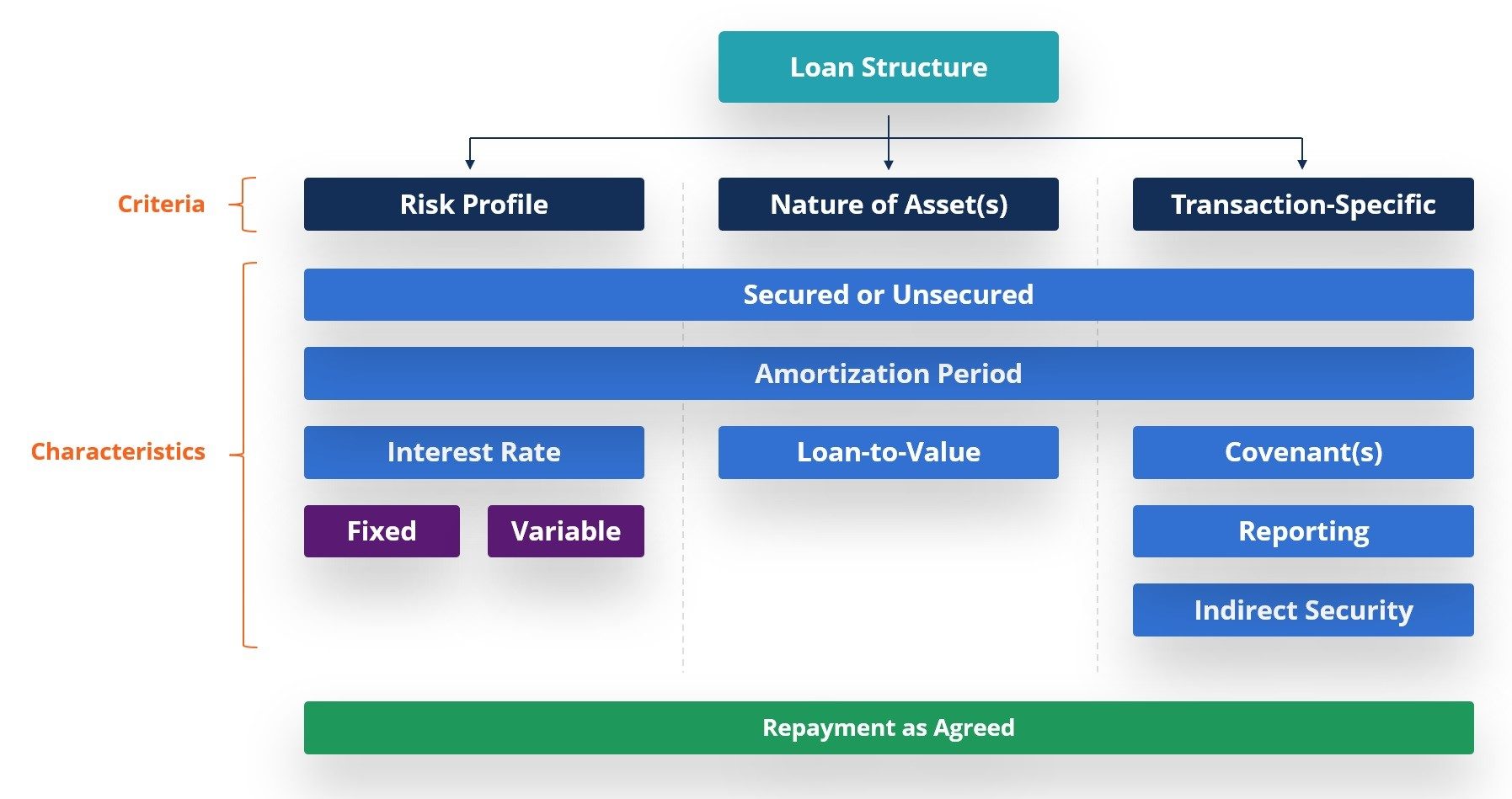

Mortgages have been in many variations and may even include fixed-price mortgage loans, adjustable-speed mortgages, or any other home loans geared to pros and you will very first-day homeowners.

Form of Mortgage loans

- Old-fashioned Mortgage brokers: Traditional mortgage brokers certainly are the most typical kind of home loan, consequently they are aimed toward customers having good credit and an excellent advance payment of at least 3%.

- Fixed-Price Mortgages: Fixed-price mortgage loans give borrowers a fixed interest, repaired payment per month (dominant and appeal), and you may a fixed repayment timeline that usually persists 15 so you can 31 decades.

- Adjustable-Rate Mortgage loans (ARM): Hands is actually 29-seasons lenders that include rates that can transform having ple, you pay an aggressive repaired interest to your earliest four age, accompanied by an interest rate you to adjusts which have business criteria.

- FHA Money: Federal Casing Administration home loans let individuals rating home financing that have effortless borrowing certificates, reduced closing costs, and you will a downpayment as low as 3.5%.

- Va loans in Twin Lakes Loans: Veteran’s Authority mortgage brokers are just having eligible army users, as well as incorporate zero downpayment needs, aggressive prices, low closing costs, and no importance of private mortgage insurance policies (PMI).

- USDA Fund: You Service away from Farming fund is covered because of the United Claims Institution away from Farming, and they help eligible consumers buy land no currency off inside the certain rural components.

- Jumbo Finance: Jumbo fund try mortgages that will be to possess higher wide variety than just compliant loan criteria towards you. In most places, the fresh new 2024 conforming financing limitsare place in the $766,550 for example-device properties.

Just how to Apply for home financing

Regardless if you are purchasing a home otherwise hoping to re-finance home financing you currently have, there are some strategies expected to undergo the method. After you look at the credit history and confirm you can aquire approved to own home financing, proceed with the methods less than to use.

- Step 1: Search Mortgage loans to find the Correct Variety of. The first step in the process was learning the sort away from mortgage you prefer, along with which kind you might qualify for. Whilst you is also browse yourself, speaking with a home loan professional to ascertain which kind of mortgage is suited to your circumstances will help.

- Step two: Examine Several Loan providers. Once you try using the kind of mortgage you desire, you really need to make sure to contrast several home loan people and you will lender even offers. Not only any time you read over user reviews and you will score, you might also want to compare lenders predicated on their reported desire costs and you may financing fees.

No Comments