ten Well-known Questions about Domestic Collateral Finance in the Tx

House guarantee financing was well-known a method to leverage an effective residence’s collateral, however they possess some book rules inside Texas. While you are interested in house guarantee loans and just have inquiries about how it works, you are not alone!

Just like any sort of economic tool, it is very important obtain the answers to your questions and understand exactly what you’ll receive toward prior to signing into the dotted range.

Texas House Equity Loan FAQ

For more information on home collateral finance as well as how it works during the Tx, we’ve amassed a listing of information and you can ways to several of the most common concerns we obtain throughout the family security fund.

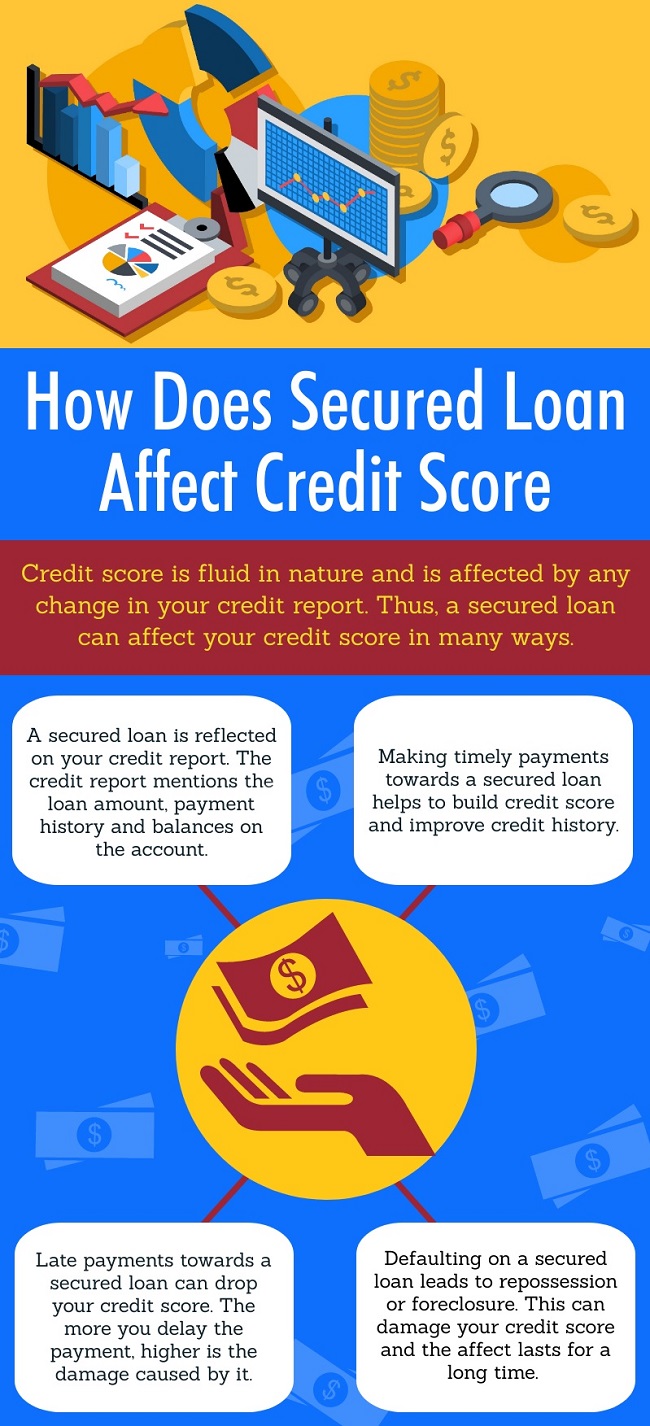

5. Ought i get rid of my personal domestic easily default to the a home equity loan?

When taking out property security loan, youre borrowing from the bank up against the worth of your property. This means that for those who default on the mortgage, the lender has got the to foreclose market our home to recoup their loss.

Having said that, this is extremely rare. Should you ever feel just like you will never have the ability to make an installment to the home financing, discuss so it together with your financial. Quite often, loan providers might help stressed individuals pick an answer it is not foreclosures.

Have other concerns about using family security? We fall apart some typically common misconceptions in the Are Household Collateral Finance best?

6. Perform I have to get my house appraised?

Sure, you’ll likely need your property appraised to decide the degree of security which you have offered. The fresh appraisal will typically feel held from the an expert appraiser so you can dictate the modern market price of your property centered on factors like:

- Updates of the house

- Top features of the home

- Location

- Present product sales out of equivalent features

- Market styles

Due to the fact appraisal is complete, you should have a far greater idea of how much cash you can acquire against your property collateral.

eight. How come a house collateral loan differ from a property collateral credit line?

Instead of acquiring their loans once the a-one-time loan lump sum, there will be a line of credit open, that enables that use from your own financial institution as needed.

Consider it just like the a hybrid ranging from a credit card and a timeless mortgage. Once you present a credit line, you’re going to be accepted to own a credit limit and you may a designated borrowing from the bank several months. When you require money, you go to your lender and you can withdraw extent you would like. You’ll pay only focus on what you really obtain.

8. Is house security financing focus taxation-allowable?

I additional that it question because it’s a hugely popular that-but we can only address it partly. We’re not tax experts, and in addition we can’t bring one taxation advice.

In certain cases, family collateral financing notice was income tax-allowable. We be concerned on occasion because this is never the brand new case for all. It is essential to demand an income tax elite group for this certain matter.

nine. What’s the interest rate for a home guarantee financing?

Like most fund, home equity mortgage rates are different based private things such credit history and you can general business criteria. How you can uncover what the interest manage seem like is to shop around and you may compare loan providers.

ten. Perform family guarantee money provides closing costs?

Colorado laws cover financial charges so you can 2% off a beneficial loan’s principal. Amplify Borrowing Union possess home guarantee financing closing costs lowest having a condo $325 closing commission- whatever the loan amount.

Convey more Concerns?

Hopefully which brief FAQ responses all inquiries, but if you have more, don’t hesitate to reach out to the mortgage professionals during the Amplify Borrowing from the bank Connection. We’re constantly prepared to help you to Nixburg payday loan online get come towards the application procedure or leave you more details concerning your loan selection.

No Comments