Such, you might result in the give contingent on providing financing acceptance or offering your home

Build a deal to your a property

After you select a house you want to buy, you ought to complete a deal on seller. It document has the amount of their render, the earnest money you intend provide (normally 1% to 3% of one’s provide number), your down-payment matter, the new expiration date of your give, and your advised closure day. Additionally include contingencies.

Fill in Home loan App

Now it’s time to try to get a friend home loan. You must fill in individual data files, normally also financial comments, employment information, evidence of money, and you may tax statements, one of most other info. Within this three days of giving your application, Friend must provide an internet financing imagine, which includes your own projected settlement costs, insurance and you may income tax can cost you, interest rate, and you will payment per month.

Before applying for an ally mortgage, make sure you has digital copies of all files you may require. If you can’t complete the application in a single sitting, this new Friend program tend to preserve your information, enabling you to initiate for which you left off during the a later big date.

Wait Throughout Underwriting

Next, your house loan application brains to underwriting, which often takes 2-3 weeks. In this process, an ally financial expert you’ll demand most data files, including a duplicate regarding a divorce proceedings decree otherwise proof pupil loan money. Brand new underwriter will guarantee the precision of one’s papers to choose the qualification into financing. For the underwriting processes, Friend you’ll setup an assessment meeting having a house assessment. On the underwriting procedure, your own Friend financial professional must provide you that have reputation about this new loan’s progress.

Get the Financial Acknowledged otherwise Refuted

Discover recognition, you’ll want to fulfill Ally’s financing direction. Acceptance depends on your credit rating, debt-to-money ratio, down payment matter, and you may a position records.

Romantic

Ally often notify you of one’s closing place, go out, and you will time and present a beneficial revelation one defines the fresh new settlement costs and you can last mortgage conditions. Antique closings need you to sign all associated data at a great specified venue. Ally even offers a hybrid closure option, enabling that electronically indication the fresh documents online and possess them notarized myself which have a good notary. Possibly, you could potentially use the latest earnest currency you paid back once you recorded an offer on your own settlement costs.

In the closure, you ought to spend closing costs, hence usually amount to 2% so you’re able to 5% of your own house’s purchase price. For instance, if you purchase property getting $300,000, you ought to spend $6,000 to help you $fifteen,000 in closing will set you back.

Ally Financial Pricing and you will Charges

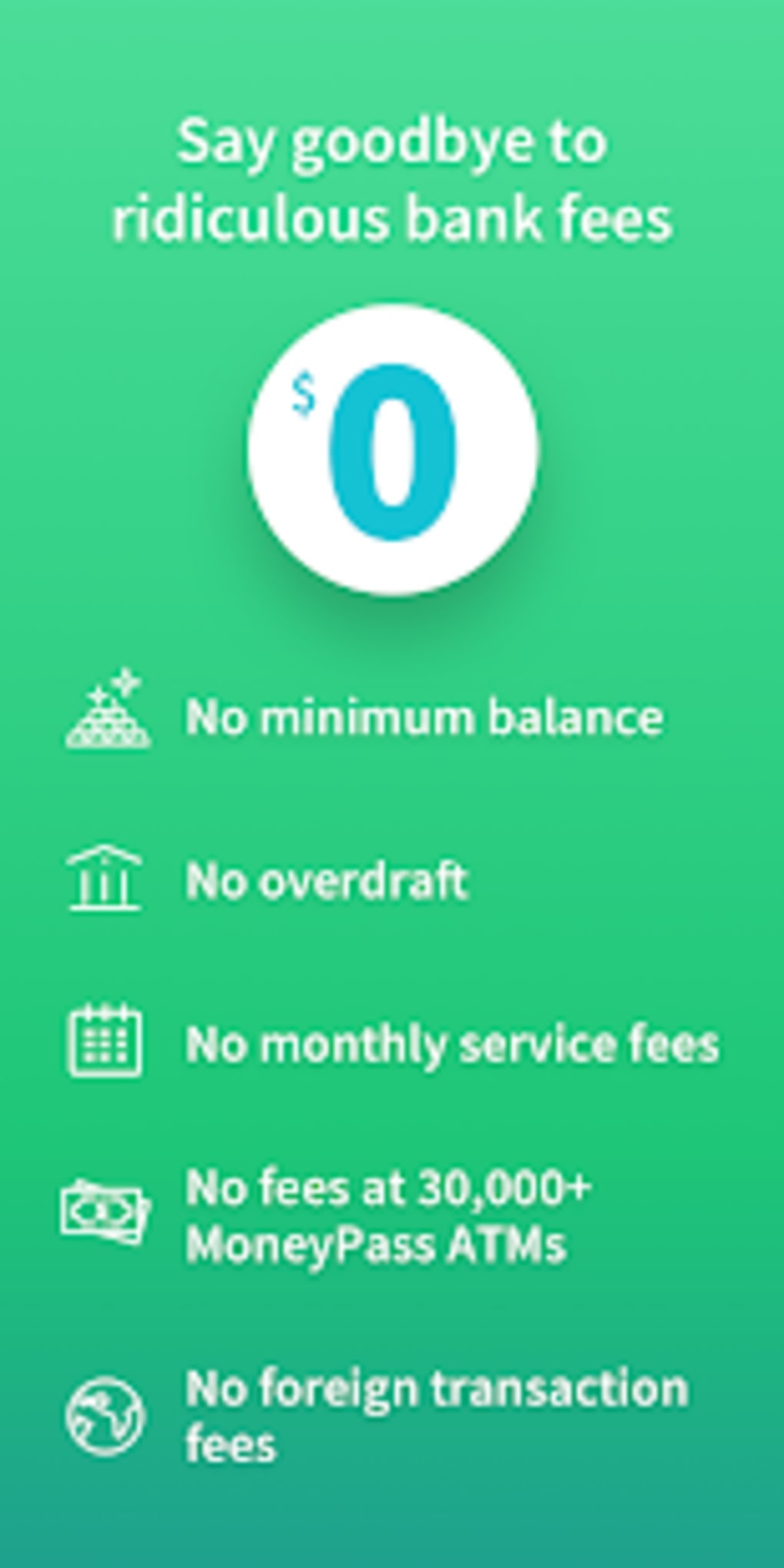

Specific mortgage brokers charges consumers an application payment and you will charge to have origination and you will underwriting. Friend Bank charge no financial charge to possess mortgage brokers.

Online Sense

Ally’s every-electronic financial means enables you to connect with the speed and you will track your own loan’s improvements http://clickcashadvance.com/payday-loans-ca/sacramento/ about capability of your pc or smart phone. The fresh new lender’s financial website landing page condition interest rates daily, that can help you decide the best time to try to get financing or request an increase lock. Given that you’ll be able to shell out zero financial charges having Friend, in addition there are pre-approved and you will complete an application free of charge.

Whether you are researching owning a home, earnestly looking property, or keeps closed a purchase arrangement, Ally’s pre-acceptance app enables you to consult pre-acceptance considering your own schedule. Immediately following you happen to be pre-recognized, you can come back to the fresh Ally web site to make an application for a loan before you go to invest in property.

First-time homebuyers will enjoy Ally’s calculators to assist them determine how much they may be able afford to obtain and exactly how financial payments commonly affect their month-to-month finances. Brand new lender’s instructional information render a great deal of information about budgeting to purchase a house, state home-buying programs, interest levels, refinancing, off repayments, and much more.

No Comments