Should i score a mortgage for five otherwise 6 times my personal income?

You’ll find “5x, 5.5x and even 6x” nowadays, offering maximum borrowings on your money. How will you get your hands on included in this?

It is really not simply hard-forced first-day consumers who require to maximise the salaries’ credit potential to get a bottom-hold on the house or property hierarchy.

Even middle-industry professionals are able to find that they must accessibility financial energy at 5 otherwise 5.5 times the yearly money to afford possessions rates about most well known domestic aspects of Uk places.

A loan provider i works closely which have has already established a mortgage for 7x your salary to have suitable applicants. Read more about it right here: NEWS: The brand new Mortgage Launch: Use 7x Your earnings.

Mortgage brokers experienced an outright limit set because of the UK’s Monetary Make Power (FCA) on the level of mortgages they’ve been allowed to question from the a lot more than 4.5 times an individual’s earnings. (Otherwise 4.five times this new combined money on the a mixed software.)

What number of resident mortgages they can bring from the a higher mortgage to help you earnings ratio (LTI) try capped from the the common fifteen% for every single quarter.

Here is the loophole you to definitely some lenders have used recently in order to provide around 6 minutes paycheck for almost all certain kinds of home loan borrowers including basic-date buyers.

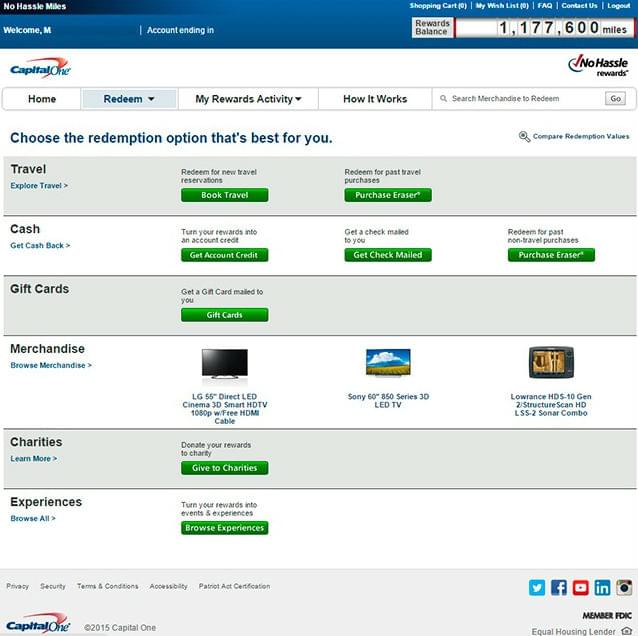

Availability a leading-LTI mortgage

- We are able to find your home financing provide with many loan providers offering revenue equal to 5 times your salary for many who secure at least ?75,100. You could establish a deposit off twenty-five% (feasible for homeowners trading upwards from inside the high priced construction elements).

- Most other associations lending just below five times income wanted just a beneficial ten% deposit.

- You to definitely financial offers 5.5 times earnings mortgages, which have a small deposit element merely 5%.

- The original-time customers they’re emphasizing you desire qualified masters such accounting firms, attorneys, chartered surveyors, architects, dental practitioners, physicians, vets and you will pilots. Plus they should be making at the least ?40,one hundred thousand per year.

- That lender provides an enormous half dozen moments paycheck financial package towards the its “benefits home loan”: getting consumers just who need to be fully certified, practising and you may registered benefits (architects, designers an such like.).

While you are here, read the latest new portion to the rising interest levels in the UK: NEWS: Try Financial Cost Going up responding to Rate of interest Nature hikes?

Huge credit to own experts

Banking companies want to do this provider that assist borrowers who will well-pay for this enhanced credit to order the latest homes these are generally targeting.

Nonetheless they wouldn’t like the brand new reputational destroy (and/or monetary loss) in the event the interest levels rise and tall amounts of property owners standard for the its mortgages.

Therefore, within fifteen% quota off high-LTI mortgage loans, they might be seeking the most profitable providers (and that is larger money) and also the safest organization.

Within have a look at, “elite certification” are shorthand having a level of studies which provides fairly hoping occupation evolution opportunities and you will employment choices in the event the a debtor loses the jobs.

Loan providers to try out secure

A pay attention to higher-earners, or these sets of borrowers, can seem to be unjust with other just as hardworking, either similarly large-generating borrowers.

On lenders’ attitude, high LTI mortgages are riskier funds. In case your borrower will lose work, there’s nonetheless a hefty mortgage repayment becoming came across every month and you may an elevated opportunity that they you are going to default.

Significant borrowing to own low-professionals: via a brokerage

Certain loan providers market its professionals’ mortgage loans selling. But when you don’t possess elite certificates, a highly-linked broker including Clifton Private Loans will bring you availableness to help you similar pricing.

- 5x your own income for folks who earn ?45K+, and you have https://paydayloansconnecticut.com/essex-village/ only a beneficial 10% put so you can obtain doing ?570K

No Comments