Seeking a house Guarantee Mortgage otherwise HELOC to possess an excellent Overseas Possessions?

Alene Laney is actually a personal financing writer devoted to handmade cards, mortgages, and you will user borrowing products. A charge card benefits enthusiast and you will mom loans in Berthoud of 5, Alene provides sharing currency-saving and cash-and make actions.

Erin Kinkade, CFP, ChFC, performs because the a monetary coordinator in the AAFMAA Wide range Management & Believe. Erin makes comprehensive monetary agreements for armed forces veterans in addition to their families.

Will you be regarding the international property? Using a beneficial HELOC otherwise household security mortgage to own foreign assets in order to fund your purchase can be far more convenient, promote most useful terminology, and enable one to pick possessions within the places that regional financing isn’t good. It also essentially enables you to an earnings client, strengthening the settling energy.

- Seeking good HELOC buying a different possessions?

- How come having fun with an excellent HELOC to possess a foreign assets performs?

- If you fool around with property security financing to own overseas possessions?

- Ways to get property guarantee loan getting international property

- Solutions in order to a beneficial HELOC having to another country assets pick

Providing you meet up with the lender’s house equity financing or HELOC standards, you should use good HELOC or domestic equity financing to have an effective international property a number of regions. However, not totally all nations or regions allow you to purchase a home if you find yourself a nonresident.

Like, The Zealand cannot essentially enable it to be nonresidents and you may noncitizens (with certain exclusions) to order a property. Vietnam, Thailand, Singapore, as well as the Bahamas also are particular countries which have certain requirements, requirements, otherwise limitations towards to invest in home if you are not a legal resident.

Consult your lending company to see if you can buy property guarantee loan or HELOC in the country where you desire to purchase a home.

How does having fun with an excellent HELOC or home guarantee financing to own a overseas possessions performs?

An effective HELOC and you can domestic collateral mortgage derive from borrowing against this new guarantee on your own latest home. Although not, you can find very important differences between these two particular domestic equity borrowing from the bank.

House collateral mortgage

A home equity mortgage lends you money contrary to the guarantee for the your home. The lending company analyzes your house’s market price, security, debt-to-earnings ratio (DTI), and you can credit score to decide exactly how much you could borrow. The mortgage usually offers a fixed rate of interest and has now a beneficial foreseeable, steady fees schedule.

House equity financing fund is disbursed in one upfront lump sum. So property collateral financing getting international property could possibly get assist you to find the property which have dollars.

HELOC

A HELOC is much like a home security mortgage, nevertheless the amount you obtain is much more versatile. That have a great HELOC, you earn acknowledged up to a quantity, therefore the personal line of credit commonly has actually a variable interest. HELOCs possibly provide low basic APRs or a draw period with interest-merely payment. With many HELOCs, you can withdraw currency as required.

- Carry out I am aware how much I need thus i is also rating a lump sum payment with a property equity mortgage?

- Perform I prefer the flexibleness of good HELOC?

- Which are the maintenance costs off a different property easily decide to use a home equity loan otherwise HELOC for these costs?

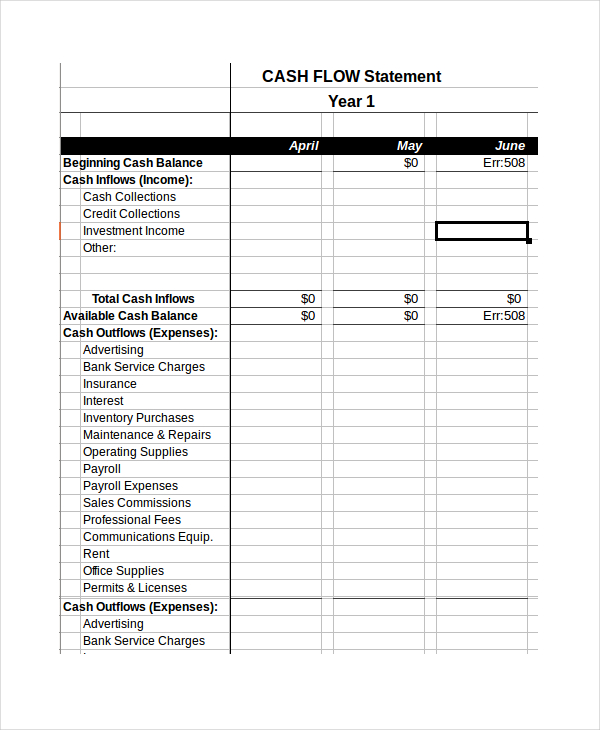

To help you choose which household collateral choice is good for your, the new desk below reveals extremely important differences when considering just how these two brands regarding domestic guarantee credit try to get a different assets.

If you have fun with a HELOC or domestic guarantee mortgage to own to another country possessions?

Using an excellent HELOC otherwise home equity loan to obtain property to another country has several experts. Such as for example, you can get much more beneficial financial support terms, such a reduced interest plus the capacity to continue your current household. Making use of your latest mortgage lender, it’s not necessary to decide a new nation’s bank system.

No Comments