Personality documents and signed package of income

Resource in the show field might risky. It is in this particular economy the Australian belongings business enjoys usually performed better. Having rates of interest at the a just about all-day lowest, if you are planning on buying a property or investment possessions, now just might function as the prime big date.

To find property was fascinating but some anyone look for obtaining home financing some time challenging. If you have never ever applied for home financing, or it’s been quite some time as you protected your one, then you may feel a small from your depth.

Within emoney, there is tailored our 5-action mortgage approval way to let consumers go from pre-app through to payment as quickly and you may effectively you could. This is how we do it.

step one. Pre-meet the requirements

To begin with you have to know early lookin to own a special family, is when much you could spend. There’s absolutely no part deciding on million money properties when you can merely manage 1 / 2 of you to!

That’s why the initial step within home loan recognition processes is to use to own a no-obligation pre-qualification. Simply enter some basic details to your our pre-be considered setting while having a direct imagine from exactly how much you is able to use.

It is vital to note prequalifying for a financial loan is not necessarily the just like approval. Which shape is dependant on everything your fill in. Credit inspections and you can possessions valuations still have to be performed in advance of you are offered authoritative recognition.

dos. Software

You can fill out their mortgage application in advance of or once you have produced a deal in your brand new home. Software acquired in the place of a finalized contract out-of profit is also get better to the brand new conditional acceptance stage, however, specialized acceptance won’t be provided before the deal away from profit could have been provided and all of conditions was in fact satisfied.

Applications have to be recorded and additionally papers to confirm your own name, your revenue, costs, assets and you will loans in Oneonta obligations. Your credit professional will let you know precisely which data we wanted, but generally they tend to be:

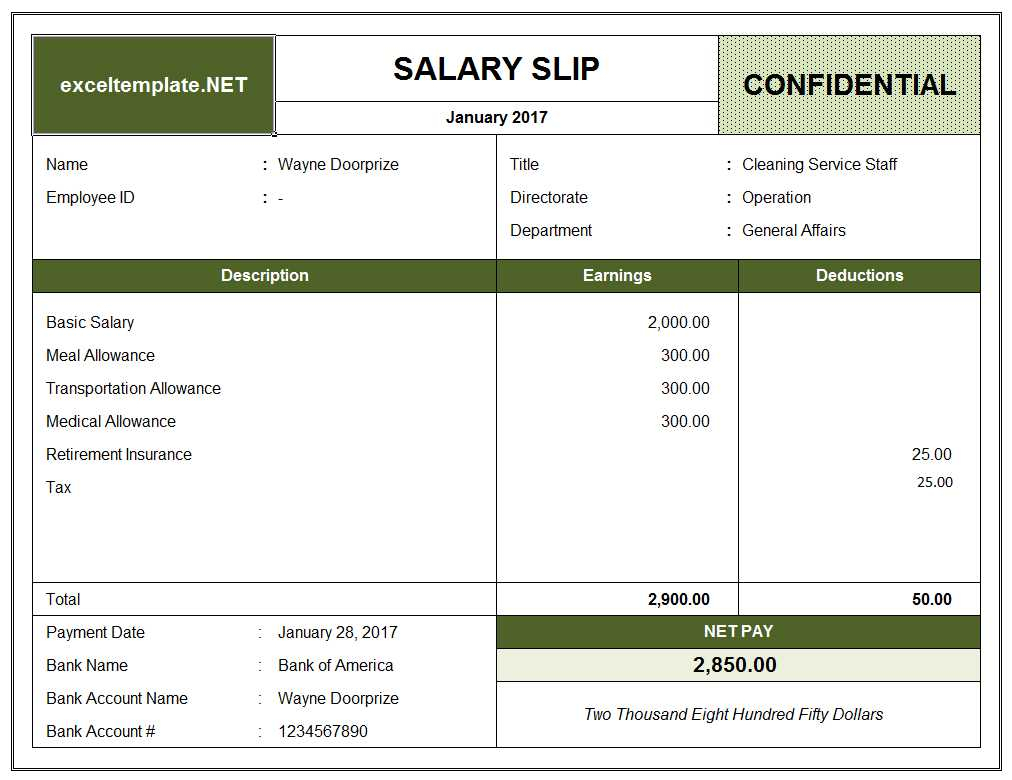

Evidence of money

- PAYG: Previous payslips the income tax analysis observes the past a couple of years.

- Self-Employed: Evidence of your own income along with men and women to suit your providers.

Information on property liabilities

- We want details of your assets and you can liabilities also factual statements about the bills. Once more your financing specialist can inform you and this data files to submit

As soon as we have received the application and all sorts of associated records, we’re going to run mortgage serviceability and you will credit checks to simply help dictate whether or not you might comfortably afford to generate money on the amount you have removed.

3. Conditional recognition

At this time, for people who registered the application before seeking a home, you’ve got 3 months to track down your brand new house ahead of the conditional approval run off and you have to use again. Notice, conditional acceptance is not guaranteed acceptance-it is conditional on the acquisition property passage analysis.

When you yourself have currently offered you towards the finalized assets contract, we shall order a proper valuation into property. The new valuation happen onsite to evaluate whether or not the property is suitable for home loan intentions. We will be available with a research outlining the newest property’s really worth and you can one relevant exposure circumstances. The final valuation will be based to the comparable sales about town plus the condition of the house.

For those who have used on use more than 80% of the property’s worth, you’re needed to pay a lender’s home loan insurance coverage (LMI) advanced. The job must be acknowledged to own LMI earlier can flow so you’re able to official recognition.

4. Specialized recognition

Immediately following all of the conditions was in fact fulfilled, your house loan is certainly going unconditional and an official approval will getting given. When you yourself have a money term from the business bargain, formal acceptance form you are now purchased purchase the property.

We are going to send the mortgage package documents into solicitor or conveyancer which you will be sign and you can return to us right that one may. New quicker your comment and you will indication the loan documents, the earlier your loan commonly settle. Once we receive your closed mortgage papers, the settlement go out is build.

5. Settlement

emoney can make the very last payment payments into the property’s vendor and will also be notified if this has had lay. You now can strategy a suitable time into the agent to pick up the newest secrets to your brand-new house.

All of our financing specialist are on hands to guide you through this procedure and will address any questions you have over the method. Give us a call for the 13 Save today.

No Comments