People will put within the term pit capital interchangeably which have connection loans

Such dealers grab an equivalent initial method to enhance & flip investors, even so they have yet another log off strategy off their bridge money

- Buy: BRRR investors come across an equivalent kind of qualities while the fix & flip dealers. They wish to see disappointed features at an intense discount. So it disregard is crucial in order to strengthening finances towards an effective deal’s budget-purchase excess into the purchase therefore wouldn’t net people cash toward selling. And you will like boost & flip investors, BRRR dealers doesn’t be eligible for old-fashioned funding due to the upset condition of these properties. As a result, however they need certainly to safer short-identity money which have hard currency loans.

- Rehab: The rehabilitation procedure to own a good BRRR individual also seems largely the brand new identical to a fix & flip price. not, BRRR people perform their rehabs with an objective in order to lease, not promote, its properties. Consequently each one of these dealers create conclusion throughout the information which have an eye to the wear and tear you to definitely renters normally apply a home. Essentially, they want to explore materials you to definitely A great) look good to help you possible tenants, B) commonly prohibitively high priced, and you will C) lasts for some time.

- Rent: Here is the step where in actuality the BRRR strategy diverges on the improve & flip one. Once renovated, people number their qualities for rental so you’re able to much time-identity, high-top quality renters. A finalized rent shows important to the next thing in the techniques.

- Refinance: Unlike settling their bridge financing of the offering services, BRRR buyers refinance the functions into the a long-title home loan, with one of these continues to settle the tough currency loan and you may, probably, require some cash-out of your own contract. But, traditional loan providers has earnings standards for very long-name mortgage loans on the financing characteristics. Many buyers do not have the money to help you meet the requirements instead leasing money, and you will banking companies generally envision a portion a great property’s lease to the customer’s income standards. Accordingly, BRRR people essentially need a renter set up ahead of they may be able secure an extended-identity financing provider and you will pay-off the bridge funds regarding the procedure.

Connection Fund against Pit Funding

These is actually equivalent for the reason that they both portray short-name capital possibilities. However,, gap funding suits an alternate purpose than simply bridge fund.

Having pit financing, buyers get a hold of a method to rating as to the he’s as to what they need to build a package happens. Such as for example, assume you can purchase an effective $100,100 difficult money loan getting property, nevertheless you want $120,100000 to help make the package occurs. If you have $ten,000 of the dollars, one nevertheless will leave your $10,100000 small to your package. Enter into pit investment. Within this example, these types of short-title capital choice render traders a method to safety you to past $ten,000 (otherwise any kind of that capital pit totals).

Residential a home investors features a good amount of gap capital alternatives, but listed below are some of one’s more prevalent of these:

These types of people take an equivalent initial approach to boost & flip dealers, however they features another type of hop out approach off their bridge fund

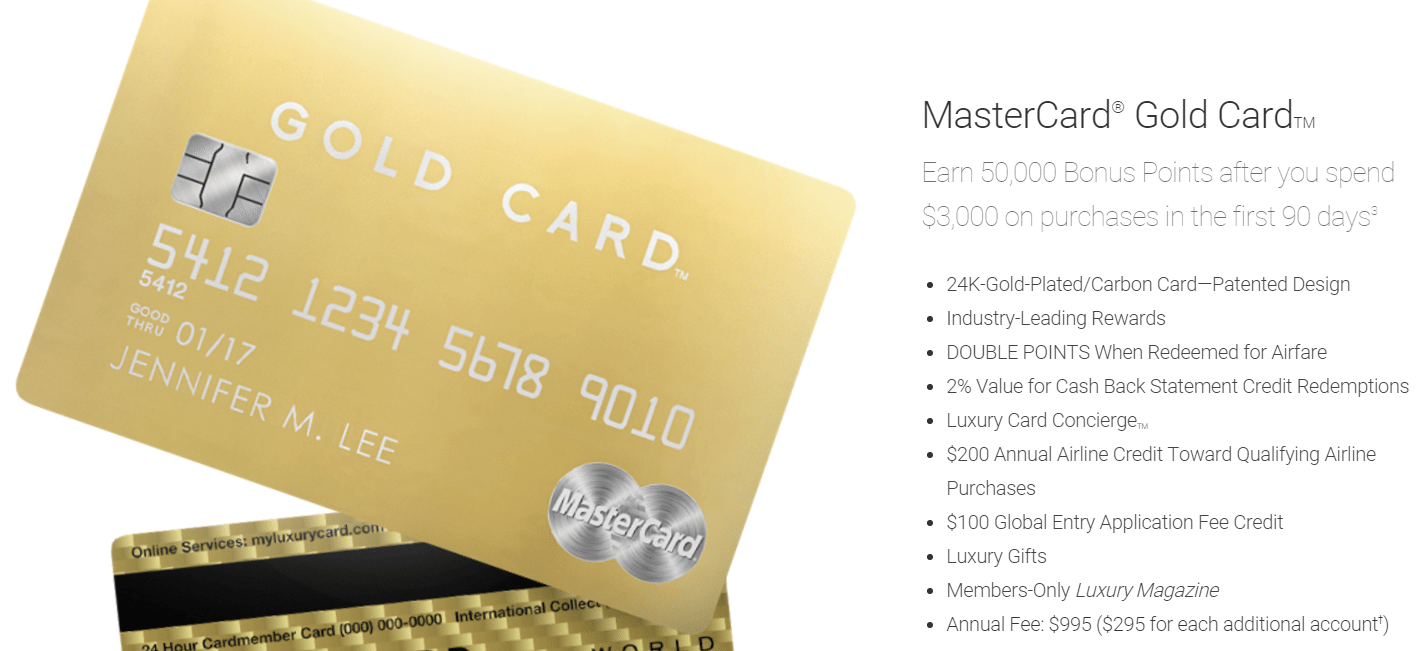

- Credit card financing : Credit card issuers wanted your bank account. As a result, if you’re a responsible borrower, they’re going to provide you with pretty good consumer loan alternatives. State you really have a great $twenty-five,100 restriction on your own mastercard, however just use $dos,one hundred thousand from it per month, constantly purchasing it off timely. There is certainly a good chance this new americash loans Millry card issuer will provide an excellent relatively low interest rates unsecured loan with the difference between the financing your frequently faucet along with your restriction. It is a great pit money method.

These types of traders need an equivalent initially approach to fix & flip dealers, even so they have an alternative hop out strategy from their link loans

- Business mate : As an alternative, you could find a corporate partner. A lot of people An effective) should spend money on a property, however, B) don’t have the time otherwise experience to achieve this. When someone have money to expend, you can probably offer them on while the a restricted-otherwise money-mate. They promote funds, have no character through the day-to-day functions, and you will found a profit on their money. Yes, you will have to compromise a fraction of their production. But if it generates the difference between investment a deal otherwise not, bringing on somebody will be a great solution.

No Comments