How Much Does An Accountant Cost In 2024?

While cost is an important consideration, it’s equally important to prioritize value and quality when engaging a team to support your small business. The cost of CPA services can vary based on the geographic location of your business. Urban areas with a higher cost of living may have higher CPA rates compared to rural regions. Hourly meetings and consultations are usually subject to the firm’s hourly bill rates and are paid in addition to the cost of the tax return deliverable. The way your business is structured has a direct result on the complexity of your tax return. When trying to decide who to hire for your accounting needs, consider the ask first.

How are accountant costs calculated?

- It is not meant to replace the guidelines set forth by the New York State Education Department, and is not the final authority in answering questions about the CPA licensure process.

- Roger CPA Review, which is now part of UWorld, also offers a high-quality review course with a focus on engaging video lectures and adaptive learning technology.

- When you get to this stage, you might wonder how to outsource these tasks to someone with more expertise—like an accountant.

- The best accounting software will help track your business income and expenses, prepare taxes and give reports on your financial status.

- Accounting software can help you automate your accounting services, track transactions as they happen, and even prepare tax documents and reports.

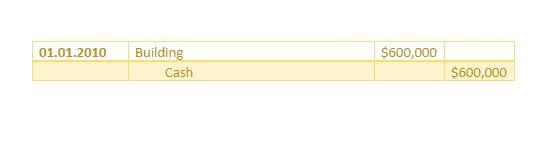

- Even in this, variations in the way that taxes are filed caused a difference in the accountant fees.

The same study from the NSA found if you are self-employed and need to hire a CPA to prepare an itemized Form 1040 with a Schedule C and a state tax return form, the average fee increases to $525. While determining CPA fees for each individual scenario isn’t an exact science, we can come up with rough approximations for the average CPA rates per hour based upon industry surveys. This can be a difficult situation to process because CPA fees do vary depending on your location, the firm you select, and the task you hire them for. While you may still find CPAs who will charge an hourly fee, many will charge set rates for specific income and tax situations based on the IRS guidelines for estimated times to complete each form. Keep in mind that professionals hired by companies such as H&R Block or Liberty Tax Service are not always licensed CPAs and may not have extensive accounting backgrounds. While the CPA fee schedule has the potential to cost more than one of these options, you may find that you save more on your taxes by entrusting them to a certified public accountant.

Business structure and tax return complexity

Roger CPA Review, which is now part of UWorld, also offers a high-quality review course with a focus on engaging video lectures and adaptive learning technology. The cost for Roger’s CPA review courses ranges from $1,699 to $2,999, depending on the package selected. Please note that the above cost breakdown is provided for general guidance and the actual costs may vary for each candidate.

- Accountants prepare tax returns with much more sophisticated software compared to the software sold to consumers.

- Accurate accounting records help you maximize your tax deductions, track money coming in and out, and plan for the future.

- In lowering your tax due, especially over multiple years, you can potentially save thousands of dollars.

- Plus, don’t forget that by outsourcing some of these important responsibilities to an accountant, you open up your time to spend on other parts of managing and growing your business.

- CPE aims to ensure that CPAs stay up-to-date with industry advancements and provide quality professional services to their clients.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- There several accounting software options you can use to run your accounting services.

What is the passing score for the exam?

The cost of these educational opportunities can vary greatly, ranging from free resources to courses priced at several hundred dollars. It is crucial for CPAs to consider their individual state board’s requirements and approved providers when selecting CPE courses. Whether you want to stay (or get) on track with bookkeeping, business payments and expenses, cash flow, or financial development, don’t underestimate the value an accountant can bring to your business. For this benefit, calculate the potential financial gain you could earn by using the CPA’s planning advice. An accountant can help you pinpoint wasteful expenditures as well as opportunities for you to save cash.

How many college credits must I obtain before sitting for the CPA exam?

An experienced tax preparer may be able to offer advice about what to do with the investment going forward. Some accountants already include a single W-2 in their tax preparation fees. However, those with multiple employees or complex payroll situations will likely incur additional charges. Although you might be able to perform some of these tasks yourself, or with the help of your accounting software, there might be valid reasons to turn to an accountant for assistance. These processes can be complex, time-consuming, and they’re certainly instances where you don’t want to make errors.

What Factors Affect the Cost of Tax Preparation?

She covers small business trends, employment, and leadership advice for the Fundera Ledger. She’s the CEO of GrowBiz Media, a media company specializing in small business and entrepreneurship. Before GrowBiz Media, Rieva was the editorial director at Entrepreneur Magazine. You can organize your books by reconciling your accounts, correcting your balance sheet and income statement and using accounting software.

Is getting my CPA License worth the CPA Exam costs?

These include live and on-demand courses online, full- and half-day conferences and seminars; on-site learning and CPE sessions. If you don’t pass a section of the CPA Exam, you will need to retake it, which means you may have to repay a registration fee and the exam section fee. Before calculating the cost-benefit analysis, you’ll want to gather some information.

The accountant might require you to invest in new software to help facilitate the job. Hiring a tax professional to manage your finances removes financial risks because the chances of making grave mistakes are almost none. When you hire a CPA, you’ll have a detailed record of all financial transactions. Continuing how much does a cpa cost to operate under these conditions can hurt your bottom line and make it challenging to grow your business. However, humans tend to be more prone to error compared to well-functioning programs. These programs can scan financial information and organize data accurately, thus reducing any possible mistakes.

- For example, Indeed reports that accountants in Houston, Texas earn an average of $65,832 per year compared to $70,533 in Los Angeles, CA.

- The accounting cost can also be affected by the amount of experience the individual possesses in the particular area you are interested in.

- The cost of hiring an accountant varies, depending on your company’s needs and the accountant’s expertise and certification.

- The testing process is similar to that in the U.S., and candidates must adhere to the same rules and regulations as domestic test-takers.

- Fixed-fee and hourly rates are easier to calculate average accountant costs because they are not always such specific situations.

No Comments