How do you rating a beneficial $20,000 do it yourself financing?

Sure, $20,000 is a good amount of cash doing multiple do it yourself methods. You may either utilize the $20,000 all-in-one endeavor eg your bathroom upgrade or if you can be pass on it doing several less tactics instance some lawn land, brand new carpeting regarding bedrooms, and you may a decorating business toward home. Property improvement loan out-of $20,000 is a superb amount of cash to obtain a great chunk from house fixes and you will upgrades over rather than increasing your financial obligation load of the a substantial matter. A great $20,000 do-it-yourself mortgage is practical sufficient that it could feel paid off in an initial length of time enabling you to complete your work, help make your monthly premiums, as well as in the brand new interim, you could begin thought and therefore plans you would want to complete next. Just like the loan are paid back, you can just take-out another type of loan to get going on what you had envisioned for another stage of one’s house’s transformation.

There are numerous methods for you to rating a $20,000 do-it-yourself loan. You could first means your own personal financial or credit union so you’re able to see what kind of funding choices are readily available for personal loans. According to your credit rating, you’re provided certain secured and you can unsecured personal bank loan choice which can have different cost solutions and you can interest rates. If you are curious about precisely what the best interest costs was offered, perhaps getting a debtor together with your credit character, you may also speak about a consumer loan option due to a keen on the web bank. Whether or not you evaluate also offers away from several different banks otherwise a great mix of finance companies and online loan providers, you need to evaluate a few also offers before selecting one. Extremely lenders promote a great prequalification procedure that would be to allow you to discover a personalized bring rather than affecting your credit rating. The procedure of bringing prequalified that have several lenders would be big date ingesting, nonetheless it need not be. At Acorn Fund you should check also provides because of the finishing one mode. Acorn Finance possess a system of the market leading national lenders that can provide personal loans as much as $100,000, according to credit history. Contained in this 60 seconds otherwise smaller you can check has the benefit of without impact on your credit rating. Second, purchase the give which is right for you or take the next step on financial. A lot of all of our financing lovers normally loans funds when you look at the as little once the 24-circumstances, in the event capital times may vary.

What is going to $20,000 enable you to get home based improvements?

There are many home improvement projects as you are able to complete to possess $20,00 otherwise shorter. You could potentially renovate your bathroom, arranged the newest flooring, create a cement garage otherwise deck, paint the house, improve your rooftop, complete an outside surroundings opportunity, set up some new doors and windows, or over a small kitchen repair. $20,000 is a great amount of cash to find much done rather than taking on a good number of debt.

Is it possible you score an excellent $20K personal loan for renovations?

Yes, an effective $20K secure otherwise unsecured unsecured loan is an incredibly preferred ways to fund renovations. Of several lending organizations offer do-it-yourself fund so you can home owners seeking bring their houses an innovative new brand new feel and look. Whether you are installing another cement garage, building a patio, or installing the new flooring, of several banks, borrowing unions, and online loan providers can help you financing your project with good $20K personal bank loan.

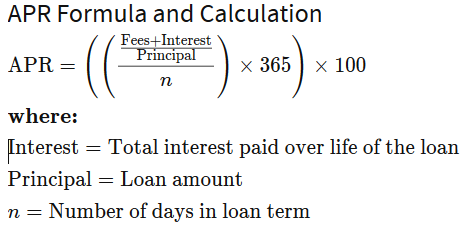

Monthly premiums toward a beneficial $20K private home improvement financing decided of the Annual percentage rate and you can the loan label. An effective 5-season financing www.paydayloanalabama.com/sylvan-springs/ is just about to has actually lower monthly installments than just an effective step three-season loan. The way to imagine monthly installments on the a great $20K do it yourself mortgage is to prequalify. When you pre meet the requirements you might change the financing title so you can get an estimated payment in accordance with the interest rate you may likely qualify for centered on your credit rating. Next smartest thing you certainly can do are have fun with that loan calculator to find certain estimated payment rates.

No Comments