Do you know the Measures of your Home loan Underwriting Process?

- The new otherwise undetectable personal debt. Not simply is financial obligation foolish, its actually dumber to consider the brand new loans when trying to get a home loan. Exactly how much obligations you have got changes simply how much (or if) your financial are prepared to loan for you. The same thing happens for those who have people invisible debt one shows up inside underwriting processes. Think about, we want to pay back any debt before getting good financial.

- Business losings. Should you get denied home financing because you missing your work, don’t be concerned. Taking on the expense from a property rather than a steady income manage destroy you economically. Pause the homeownership desires for the moment and focus toward rating good the latest business.

- Issues with the house. Okay, listed here is one you can’t really handle. If the a home appraisal shows something very wrong towards household or that it is value below the sales rates, your underwriter you’ll refuse your loan. Let me reveal as to why: If you’re unable to create costs plus bank repossesses the house, they wouldn’t be able to public auction it off having enough currency to earn right back the bucks they loaned you.

While it is not what we would like to pay attention to, bringing refused that loan to own reasons connected with your funds is largely the best thing. Sure, new underwriter is protecting the newest lender’s ass. But you’ll feel protected as well!

Delivering refuted setting you might not getting household worst or enjoys endless money fights with your spouse since you be unable to make finishes fulfill. And will also be capable focus on having your economic lifestyle manageable prior to getting you to definitely home!

The whole process of delivering recognized to possess a home loan because of the a keen underwriter can appear such as a great deal. So let’s fall apart brand new measures it will take to get the environmentally friendly white.

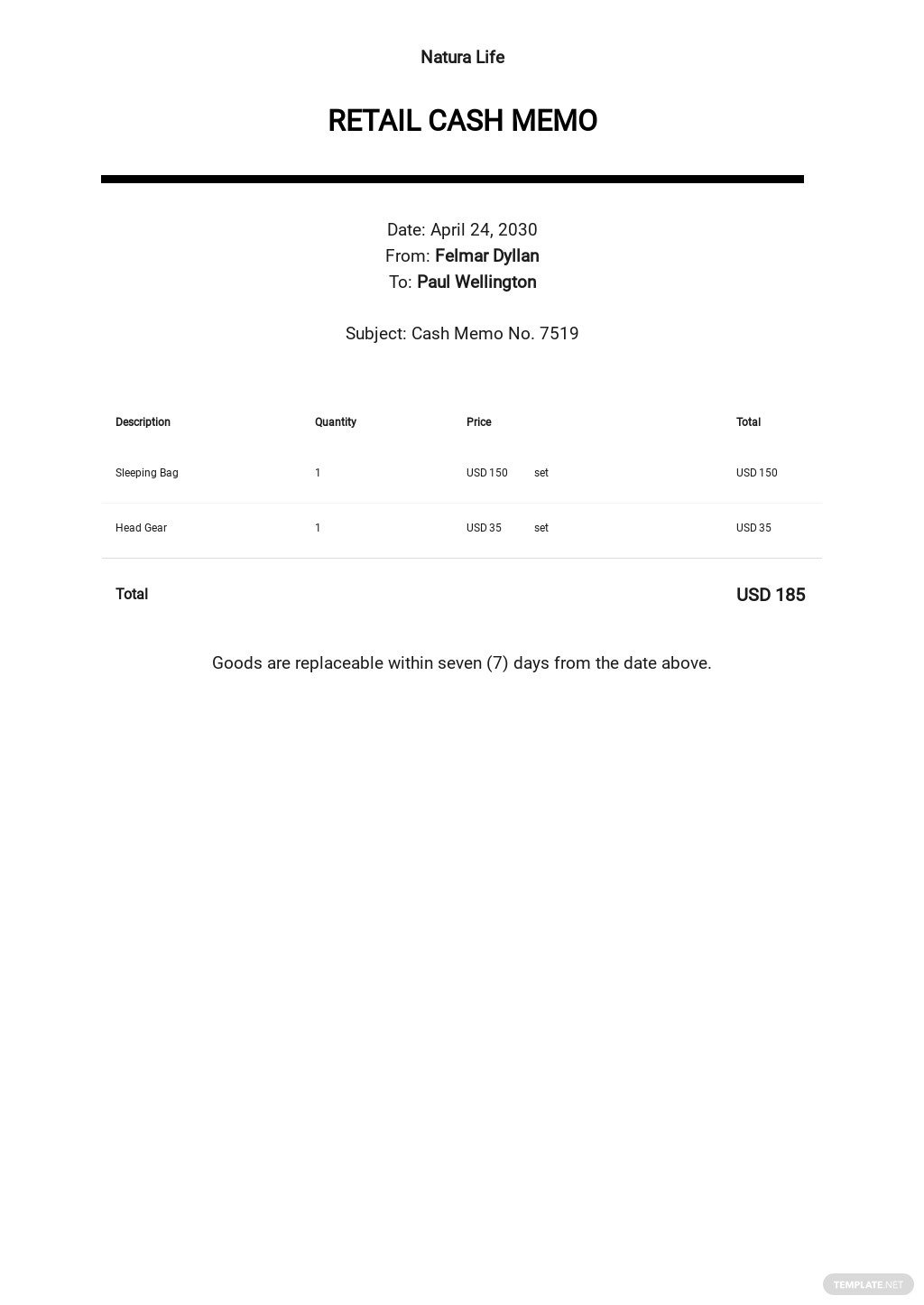

Step one: Sign up for the borrowed funds.

Before you score a mortgage, you really need to submit an application. This can be done personally with your bank or electronically. You may need certainly to offer more info up to now. Don’t get worried-their lender allow you to know exactly what they need!

2: Receive the financing estimate from the financial.

After your loan software is received, their bank provides you with a loan guess to examine. That it document explains about what you can easily buy their monthly mortgage payment, total price and you may principal in the 1st 5 years-in addition to % you pay from inside the focus along side longevity of the mortgage. Think about, this is just a quote. You are getting last quantity as part of your Closing Revelation (select action six).

Step three: Get financing canned.

Time for you get your records in order! In this stage, your own bank or financing chip have a tendency to consult paperwork toward personal and economic facts out of your financial app. Since data is attained, the newest underwriter starts examining all of this studies to look for people openings otherwise hazards.

Step four: Anticipate the home loan as acknowledged, suspended or rejected.

The new underwriter can either accept, Lisman loans suspend otherwise deny your own mortgage loan app. For the majority things, this new underwriter approves the borrowed funds application for the loan-however with conditions or contingencies. This means you’ve kept try to manage otherwise details so you can render, such as a great deal more files or an assessment.

Action 5: Obvious one mortgage contingencies.

This is where you’ll focus on your own lender to be sure you eliminated those contingencies they utilized in step 4. Plus, the financial tresses in your interest rate. As the conditions have the ability to become found, you will get a obvious to shut from your own financial. Which means the mortgage loan is able to be closed to the closure time.

No Comments