Differences when considering a funds-aside re-finance and you can a home guarantee financing

A house collateral personal line of credit (HELOC) is a good rotating line of credit that actually works brand of such an effective bank card. You might spend money as required and work out repayments back into your own personal line of credit. Just, rather than borrowing from the bank from the bank card team, you’re drawing up against your house security. A finances-away refinance, at the same time, is actually a loan providing you with you a lump sum payment of cash at the closure.

Money aren’t available to owners of the many claims and you can readily available financing terminology/charge ounts are anywhere between fifteen,000 and you may $150,000 and tend to be tasked centered on debt to earnings and you may loan to really worth

A home collateral mortgage, or HEL, is additionally entitled the second mortgage. Domestic collateral funds allow you to borrow on the fresh guarantee when you look at the your property at an easily affordable rates

A property equity financing enables you to borrow secured on the newest collateral within the your residence having a fixed rates and you may repaired monthly installments.

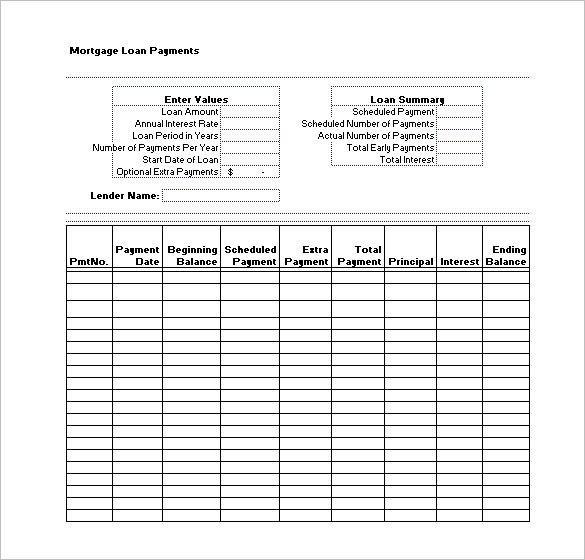

Training blogs try fun, however, obtaining the really super tables makes it much simpler plus enjoyable. Catch types of the best.

Funds are not available to customers of all the says and you may readily available mortgage conditions/charges ounts try anywhere between 15,000 and you can $150,000 and they are assigned predicated on financial obligation so you’re able to income and you can mortgage so you’re able to worth

A home guarantee loan, otherwise HEL, is additionally titled the next home loan. Home collateral loans enables you to borrow secured on the brand new guarantee within the your residence on a reasonable price

A property collateral loan enables you to borrow against the brand new security when you look at the your residence having a fixed rates and you will fixed monthly installments.

Understanding articles was enjoyable, however, acquiring the most very dining tables makes it easier plus pleasing. Connect samples of the very best.

Achieve ‘s the leader inside digital private money, built to help people progress on the road to a better economic upcoming.

Learn how a home collateral loan work

Signature loans come as a result of our representative Get to Unsecured loans (NMLS ID #227977), originated by the Get across River Lender, a new Jersey State Chartered Industrial Financial or Pathward, Letter.An excellent., Equivalent Casing Lenders and may even not be found in all of the says. All the financing and speed terms and conditions try susceptible to qualifications limitations, software feedback, credit score, amount borrowed, mortgage label, financial approval, credit use and you may record. Loans aren’t accessible to residents of the many says. Minimal mortgage quantity are different on account of state particular courtroom limitations. Loan amounts fundamentally range from $5,000 in order to $fifty,000, will vary of the condition and therefore are offered considering conference underwriting standards and you can financing goal. APRs start from 8.99 in order to % and include applicable origination charge that vary from step 1.99% so you’re able to 6.99%. Brand new origination payment are subtracted in the loan continues. Installment periods cover anything from 24 so you can sixty weeks. Example financing: four-12 months $20,000 financing that have an origination commission off 6.99%, a rate off % and you may relevant Annual percentage rate away from %, might have an estimated monthly payment regarding $ and a complete cost of $twenty-six,. So you’re able to be eligible for a 8.99% Annual percentage rate mortgage, a borrower will require excellent credit, an amount borrowed less than $twelve,, and you will a phrase out-of two years. Including a beneficial co-debtor with plenty of earnings; using about eighty-five per cent (85%) of the loan proceeds to pay off qualifying established obligations in person; otherwise demonstrating evidence of adequate senior years savings, can help you as well as be eligible for down rates. Funding cycles is quotes and certainly will are different for each and every financing demand. Exact same go out behavior assume a finished application with all of needed support records submitted very early sufficient towards a day which our practices try unlock. Reach Personal loans period are Monday-Saturday 6am-8pm MST, and you will Friday-Sunday 7am-4pm MST.

Domestic Collateral loans are available thanks to the representative Achieve Money (NMLS ID #1810501), Equivalent Houses Financial. Every loan and rates terms and conditions are susceptible to eligibility constraints, application opinion, credit score, loan amount, financing label, financial recognition, and you can credit utilize and you will background. Lenders are a line of credit. Example: mediocre HELOC was $57,150 which have an apr out of % and you can estimated payment per month of $951 for a beneficial fifteen-12 months financing. Minimal 640 credit history applies to debt consolidating needs, lowest 670 applies to cash-out demands. Almost every other standards pertain. Repaired rates APRs range from 8.75% – % and they are assigned predicated on credit worthiness, mutual mortgage so you’re able to worth, lien status and you may automatic percentage subscription (autopay subscription isnt an ailment out-of mortgage acceptance). 10 and you may 15 season terminology available. Each other terminology enjoys an excellent 5 year draw period. Money are fully amortized throughout each several months www.paydayloanalabama.com/cullomburg and you will determined toward a great dominant harmony monthly. Closure costs range from $750 so you’re able to $6,685, dependent on line count and you may condition law conditions and generally are origination (2.5% out-of line matter minus fees) and you will underwriting ($725) costs in the event the allowed for legal reasons. Property must be owner-filled and shared loan to value might not go beyond 80%, including the the latest loan demand. Property insurance policy is called for as the a condition of your own financing and you will ton insurance coverage may be required when your topic house is found in a flood region. You ought to vow your house once the security and might remove their house if you fail to pay off. Contact Achieve Funds for additional information.

No Comments