What’s the monthly fees toward an excellent ?250,000 financial?

Searching for a separate household? If you are searching to purchase a house having an effective ?250,000 mortgage you are wondering how much their monthly repayments would-be. As with every mortgages, might differ based on your own term, interest levels and the measurements of your own deposit. To acquire an idea of exacltly what the costs you will definitely be, check brand new review dining table one to we have developed to you predicated on rates and you may terms.

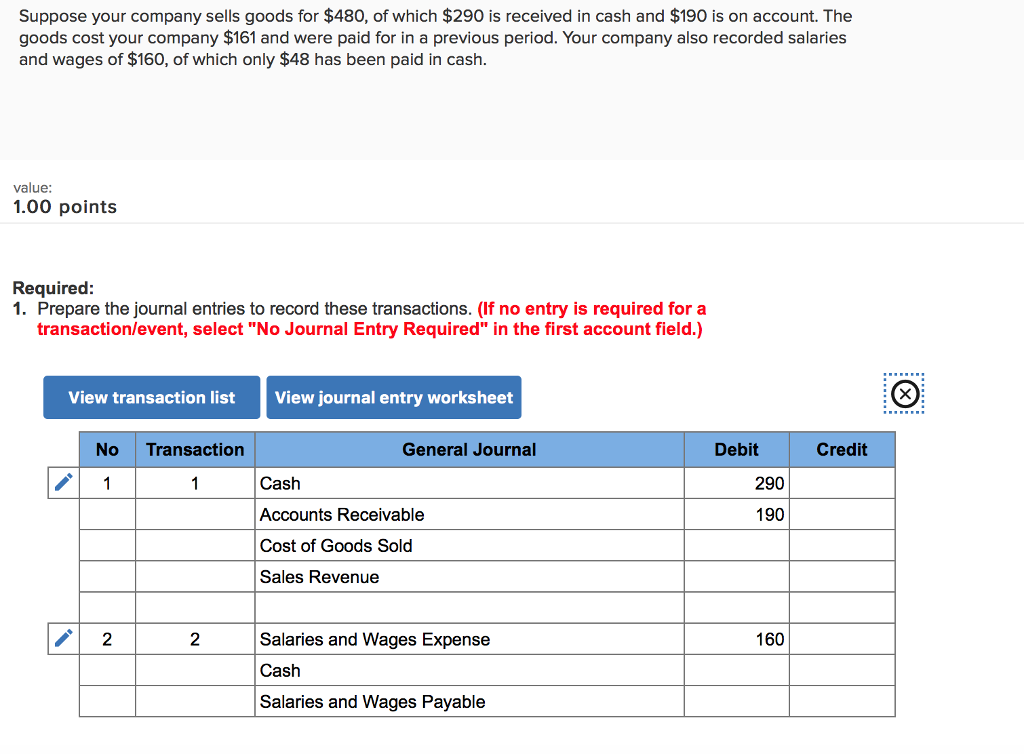

250,000 mortgage payments

Such rates will be just be treated just like the helpful information and never mortgage information. These data are all predicated on a fees financial, maybe not an interest just mortgage and you may determined toward Currency Assistant financial calculator using a great ten% deposit.

Just how much deposit would I wanted for an effective ?250,000 home loan?

- Lenders basically give mortgage loans to the people who’ll offer the very least deposit of five-10%.

- 5% do equate to ?12,five-hundred for an excellent ?250,000 mortgage but bear in mind that your particular month-to-month money will end up being highest that have a lower put.

- Possibly, lenders get prefer to an effective 15% put which will be ?37,five-hundred getting a good ?250,000 mortgage.

- All financial varies so there are plenty of activities one to contribute to in the event the financial application could be recognized eg home money, credit history and you will a career record.

Should i afford a ?250,000 mortgage?

Affording an excellent ?250,000 mortgage hinges on lots of different things, including your 1st deposit as mentioned over, plus income and other bills. You’ll need to be certain that you can afford the fresh month-to-month costs ahead of it accept the application. First, you will need children earnings that may safety the brand new monthly money and you will a larger put will even support your instance.

A place to begin is through figuring their monthly paycheck, account for some other regular outgoings that you have and researching so it with the monthly obligations, considering mortgage terms and conditions and you will rates of interest. There is a downloadable budget planner that’s of good use when creating what you down.

Does becoming notice-operating connect with providing a ?250,000 home loan?

Paycheck is not surprisingly one of the greatest situations in your eligibility getting home financing as it’s how the bank notices you are in a position to pay off the borrowed funds. Certain lenders would be reluctant to offer mortgage loans to worry about-employed some one, particularly if it’s hard to prove which you earn enough a-year to fund your payments. It’s not impossible regardless if, particularly if you keeps a reputation earning sufficient money so you’re able to security their month-to-month mortgage payments and without difficulty reveal which to the lender.

You’ll need to demonstrate to them between you to three years regarding profile to prove you really have adequate money and you can earnings from the organization and you will certainly be able to show you have the put https://paydayloancolorado.net/longmont/ too. If you’ve delivered on your own-Assessment income tax come back to HMRC for the past several years Income tax Overviews otherwise an excellent SA302 is enough. You could tell you financial work details, specifics of next plans otherwise chose account. See our thinking-operating home loan guide for the majority of much more guidance on it condition.

How much cash ought i earn to own good ?250,000 financial?

While a good PAYE earner, lenders will normally provide as much as four times your own yearly salary. If you don’t currently earn which, you could potentially imagine trying to get the loan which have somebody else instance someone. The borrowed funds bank commonly factor in your household money, but you must ensure you really can afford new money to each other together with your other month-to-month outgoings. Browse the Nottingham’s managing money while the several blog post in the event the you find attractive being a great deal more open together with your partner regarding your bank account.

I don’t have an upper limitation to have purchase to allow mortgages, however you will generally you would like a larger put than simply if you were to acquire someplace to live your self. Of several buy to let mortgage loans is actually appeal-merely and you will have their own particular terms and conditions including your might have to currently own an alternative possessions, and you will expect you’ll pay a twenty five% deposit.

There can be far more will set you back in the short term, including expanded terminology and better interest levels. Of a lot activities can impact your application, together with your ages and you may money and the borrowing and you may work activities that we’ve mentioned before.

Are you willing to get ?250,000 attention-only mortgage loans?

Sure, ?250,000 desire-just mortgage loans arrive however, there are certain things to consider and therefore we have given just below. Definitely, the lender commonly inquire to see facts that you will be in a position to pay back which loan like your money and you may credit history.

- No funding (the total amount your obtain) try paid unless you build overpayments.

- Due to the fact you’re not paying off a part of the borrowed funds per few days, you’ll need a means of repaying the complete property value the loan when you’ve achieved the termination of the term.

- Of a lot get to allow mortgage loans is actually desire-merely, so you might manage to use people spared income away from rent money to expend it well at the conclusion of the fresh new term.

No Comments