Completed Using Your home Mortgage EMIs? Ensure Their NOC

Homeownership try a dream for many, and you can efficiently repaying home financing is good milestone really worth celebrating. Although not, your way does not prevent into the final payment of one’s mortgage. There is certainly an important step you to remains: obtaining your own No Objection Certification (NOC) called Mortgage Closure Letter. This document is very important on the changeover regarding a borrower in order to a sole property owner. Less than, i explore the newest the inner workings of the NOC, the advantages, as well as the procedures working in securing it.

The first step try making sure most of the dues is actually cleared. This consists of brand new payment of last EMI and you can one related charges or charge. Confirm into lender that your particular financing membership reflects a zero balance and ask for an account closure statement.

step one. Making sure Precision throughout the NOC

Once you receive the NOC, it is vital to consider every piece of information carefully. This includes the label, property details, loan membership matter, or any other relevant suggestions. One mistake on the NOC can result in challenge from the future.

dos. Updating Authorities Details

With the NOC at your fingertips, the next action is to obtain the home ideas current. This requires visiting the regional civil authority or the home records office to remove the fresh new bank’s lien on possessions label.

step three. Safekeeping of one’s NOC

Store the fresh NOC during the a safe set. It is an important file for coming deals amongst the assets. Dropping it will lead to unnecessary judge complications.

4. Asking an appropriate Advisor

If you are not knowing regarding the one help the method or this new court implications of your NOC, you may want to see an appropriate mentor. Capable provide recommendations and ensure that every tips is actually accompanied correctly.

Prominent Pitfalls to prevent

- Impede when you look at the Obtaining NOC: You should never procrastinate into the obtaining the fresh new NOC immediately after cleaning your loan. If your financing is paid off, initiate the method to obtain the NOC.

- Not Looking at the brand new NOC: Make sure that everything about NOC is exact. Discrepancies about file may cause legal issues after.

- Not Upgrading Regulators Ideas: Maybe not updating government records on NOC can produce challenge in future visit here transactions. It’s important to over this task to ensure clear possession.

Paying off your residence financing is actually an achievement, your obligation cannot prevent around. Having the NOC is actually a significant part of fully starting your own possession and you will ensuring that you face no legal difficulties regarding the upcoming. By using these tips, you could make sure a softer transition on the as being the unencumbered manager in your home.

Frequently asked questions Regarding NOC having Financial

Sure, getting a zero Objection Certificate (NOC) is important following the closing off that loan. The fresh NOC was an appropriate file given by the lender (bank otherwise standard bank) guaranteeing the mortgage might have been totally paid down and that they have no allege across the property. Its crucial for cleaning the brand new label in your home and you will indicating there are no an excellent fees associated with the they.

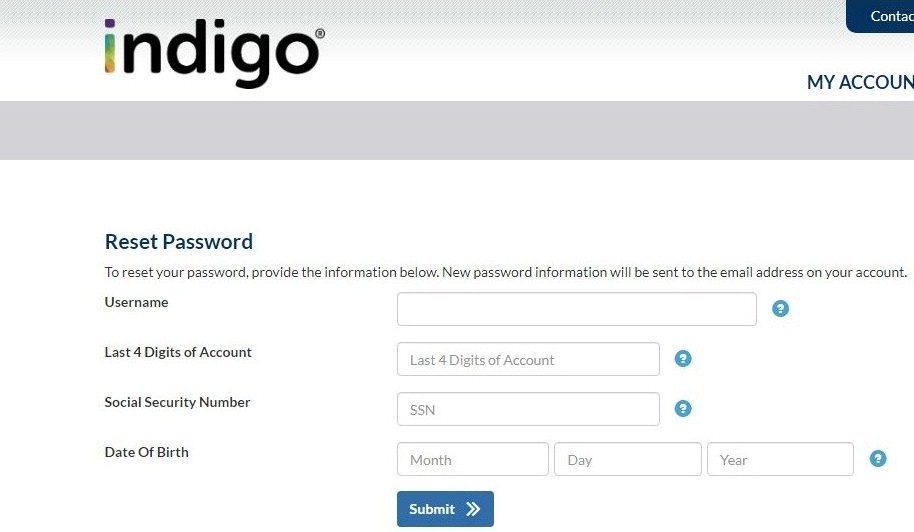

Request good NOC from your bank. This will usually performed using the customer service service or during the branch where you took the mortgage.

Of several lenders today render online establishment to have obtaining a keen NOC. You would usually have to log into your account on lender’s web site and implement into NOC underneath the loan administration section. not, the available choices of this particular service may vary with regards to the financial.

Basically, a NOC to possess a home loan doesn’t have a termination time. Just after approved, they stays legitimate forever as it is an affirmation that the mortgage might have been completely reduced while the bank does not have any allege towards the possessions.

As mentioned, the fresh NOC for a mortgage normally doesn’t have a legitimacy period. It is a long-term document that certifies the closing of the mortgage.

Things in the future Deals: Selling the property or making an application for an alternate loan facing it can end up being challenging without an NOC since evidence of financing closure.

No Comments