The initial step during the doing the mortgage application process would be to rating organizedpile very first records and you can monetary ideas early

In a number of urban areas now, real estate are a seller’s market. Which have multiple consumers lined up for 1 property, you could potentially overlook home to your desires rather than a loan preapproval available.

While farm and farm real estate business elizabeth rules still use. Performing your quest before applying to have financial support, you can set on your own in a primary position to move when the proper possessions will get offered.

Start early.

“The method for both the customers while the mortgage manager goes more smoothly if the information is bundled up-and done,” claims Justin Wiethorn, Texas Land-bank regional chairman. “If the an applicant can’t obtain it during the, it contributes an additional or third round out-of realize-right up, which waits crucial processes and certainly will become hard into the consumer.”

Wiethorn claims he or she is a proponent of experiencing preapprovals, and in some cases could offer an https://paydayloanalabama.com/gurley/ excellent preapproval that’s a great to possess 6 months. The guy plus uses now to educate users who aren’t while the used to the borrowed funds process on the some portion needed afterwards, eg surveys, identity really works and appraisals, so that they know what to expect.

Details amount.

From inside the instances of earlier delinquencies, be honest. Really loan providers declare that sleeping or withholding data is among by far the most detrimental anything an applicant is going to do. Factors is sometimes looked after, therefore staying the borrowed funds administrator informed regarding the very beginning can be save yourself crucial big date. This also enforce when getting a thorough dysfunction of your residential property being offered because coverage.

Understand your credit rating.

Amanda Simpson, assistant vice-president with Alabama Farm Borrowing from the bank, refers to an unfortunate scene this lady has seen enjoy call at their own workplace time and time again.

“I’ve had a potential customer have been in expecting the credit rating are 100 factors higher than its, because they do not realize that a credit report try focus on dozens of the time when they had been auto searching and you may greet certain people to get their get, or a health range appears due to a delinquent costs from ages before your applicant doesn’t have idea is obtainable,” she claims. “In our branch, we usually you should never eliminate a credit history up until we feel there is actually a legitimate application for the loan – definition i’ve a complete financial statement, credit agreement and other suggestions dependant on this consult.”

When you find yourself actual downpayment conditions may vary, he could be normally predicated on borrowing activities examined from the financial. Wiethorn says that the community important to own domestic financing is 20 per cent, and you can discovering one sum of money should be a keen challenge for almost all candidates. This is also true for younger otherwise very first-big date individuals, or people that gotten home loans having small off payments for the the past few years and will has a hard time transitioning on industry standard.

“Farm Borrowing from the bank does have financing system for young, beginning otherwise brief companies, which has less limiting credit requirements to enable them to with the changeover on the farming otherwise ranching,” Wiethorn states. “This includes down payment standards, including our power to work with external offer, including the Farm Provider Department. If you’re there are some limitations with the access to this method, this has been an effective tool to assist particular more youthful prospective individuals along with their very first property get.”

Learn the “Four Cs out-of Borrowing from the bank.”

- Character: the new borrower’s honesty and you will integrity

- Capacity: the new applicant’s financial power to pay-off the loan

- Capital: the newest applicant’s exchangeability and you can solvency

- Collateral: the fresh new actual assets that may get rid of new lender’s risk throughout the experiences regarding default

- Conditions: brand new requirements to own giving and you may settling the mortgage

“The newest ‘five Cs’ will keep your from problems,” Kenneth Hooper, Panhandle-Plains Land bank senior vice president/part director, states. “Ranch Borrowing provides constantly caught on it, and i believe it is one reason why our bodies has succeeded for over 95 age. It is old content, however it works.”

Get acquainted with your financial.

Even in the event a candidate is looking for “approval” off a lender throughout the an application procedure, lenders do need certainly to behave as a team toward applicant. Specifically having Ranch Borrowing from the bank lenders, Simpson states one to due to the fact Ranch Borrowing from the bank focuses on outlying lending, she wishes their own users to feel they can call on her for many concerns regarding its functions.

Hooper agrees, and you will says one to a great mortgage officer commonly put a lot from performs into strengthening a strong rapport having users.

“That loan officer ought not to you should be individuals event documents,” Hooper claims. “I intend for it to be a lengthy-identity relationship, and want to feel helpful so that as much of a development supply that one can – now and later.”

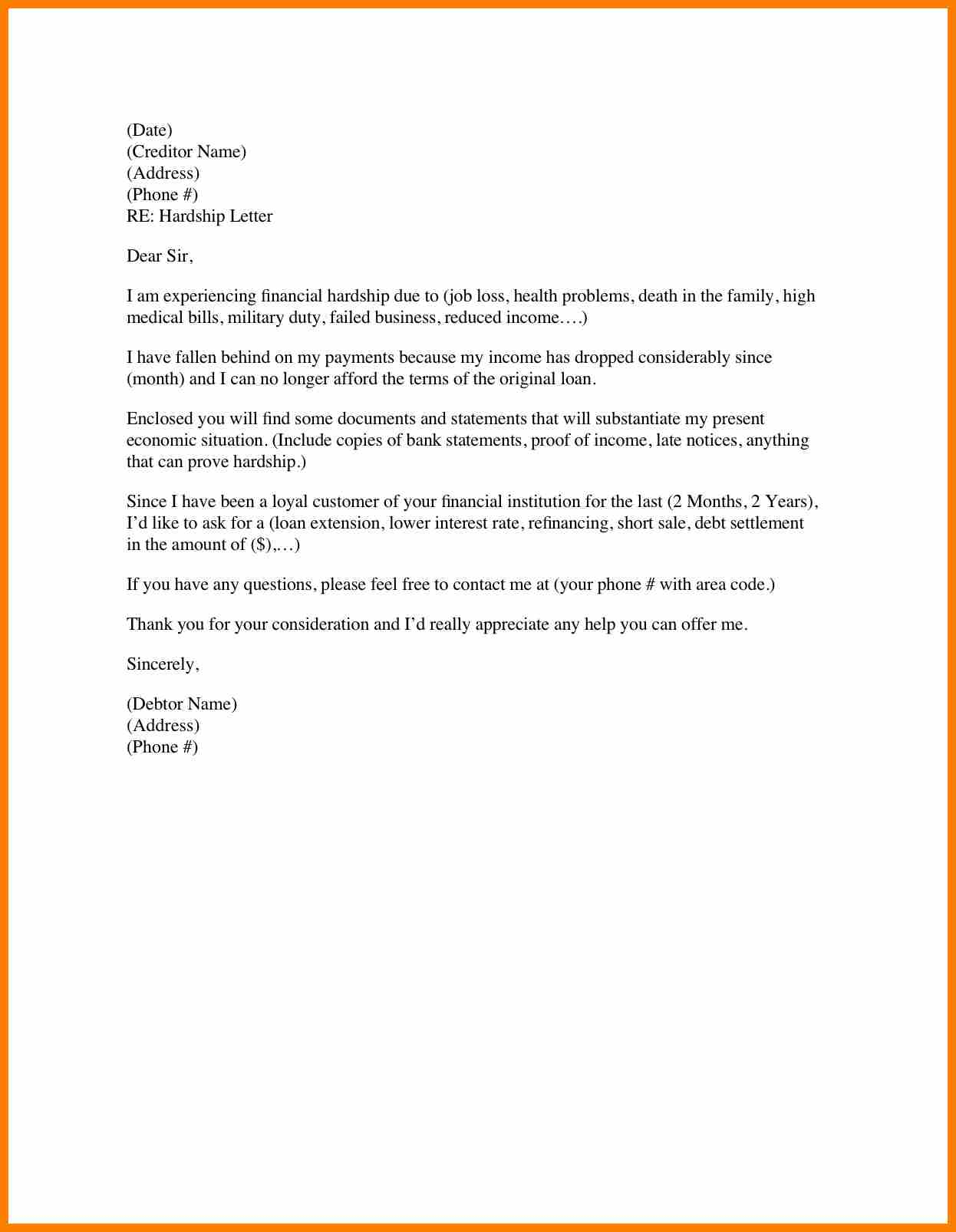

A file Number

Due to the fact listing of certain documents may differ away from lender to bank, all mortgage officers will for the next:

App and you can most recent financial record: These types of forms will be given from the financial. Independent economic comments would be necessary for personal and you will relevant entities instance partnerships or companies in which the candidate enjoys an enthusiastic desire.

Earlier 3 years out of completed tax statements: Panhandle-Plains Land bank Older Vice president/Department Manager Kenneth Hooper states your cause for 3 years out-of efficiency (which is practical to have agricultural loans) isnt to acquire good decades otherwise bad many years, but to get trends when you look at the income.

Courtroom malfunction of land provided since the safety: For example a deed otherwise survey, accompanied by a keen aerial photos otherwise a great surveyor’s plat. If your given safety is actually a rural house, an effective surveyor’s plat must be offered.

Deals and borrowing guidance: The lender need duplicates of all lender statements, certificates of deposit, common money, holds, securities, etcetera., for every single candidate.

Authorization mode: So it authorizes the financial institution to find credit file; a job and you will earnings verifications; advice regarding property, liabilities or insurance; and every other guidance wanted to finish the app.

Construction data files: A software getting a housing financing need is a complete set away from preparations and you can criteria or a copy of one’s framework bid or offer signed of the applicant in addition to builder.

No Comments