In reaction to the reforms, currency sector money executives and you may investors managed to move on $step 1

As the move with the FHLB’s deeper reliance upon short-identity funding began in the past, now which shift appears to have already been provided even more support of the outcomes of the SEC’s reform out-of primary currency market fund. dos trillion off best currency loans in order to bodies money fund, which happen to be limited by carrying essentially just Treasury and you may company ties–and additionally the individuals approved by FHLBs–and you will Treasury- and you will company-backed repurchase arrangements. Once the shown in the kept committee of Profile 4, after , nearly you to definitely-5th of currency fund industry’s three trillion dollars profile is purchased FHLB debt. cuatro Moreover, the show off FHLB loans stored by money fund–revealed around panel of your own contour–has increased dramatically, so when from endured within over fifty percent of all the outstanding FHLB debt. 5 And, due to the fact revealed by red-colored range in the correct committee off the new profile, currency financing keeps reduced the newest adjusted mediocre readiness (WAM) of the FHLB personal debt-carrying. six

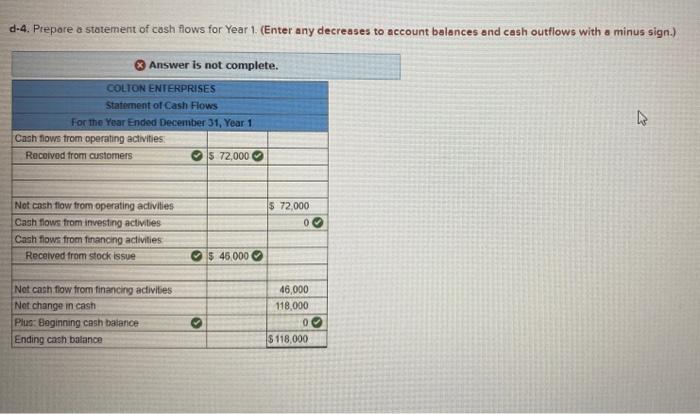

Figure 4: Currency funds and you can FHLB personal debt

The bucks loans change seems to have offered FHLBs a deeper virtue within financing costs prior to loan providers one to depended toward funding out of prime currency loans. Due to the fact shown by the red line into the Profile 5, brand new weighted mediocre price to your FHLB personal debt held of the currency financing as of the conclusion involved 10 foundation factors less than that primary money finance, denoted by dashed black line. eight Consequently, for creditors it could are particularly cheaper for financial support intermediated by FHLBs than just resource from currency loans.

Contour 5: Adjusted mediocre produce into products stored by currency fund

The elevated credit by highest players along with seems to have altered the sort off battle one of FHLBs. Usually, FHLBs didn’t compete having business certainly themselves due to the fact participants just work in one region hence for every single had the means to access simply one to FHLB. However, many large banks and you can insurance holding people have subsidiaries that is people in several FHLBs. Carrying people can and you can create seem to take action a level of sector stamina by altering its borrowing to FHLBs that offer ideal terms, thereby dealing with to lower the speed pass on of their improves over FHLBs’ capital can cost you. Considering the large this page number of maturity transformation by the FHLBs, the little margin ranging from rate of interest off enhances and you may FHLBs’ funding pricing would-be puzzling. It small margin could be partially due to the fact that most of advances was acquired by the large professionals with entry to lower small-label cost. Hence, about for the margin, FHLBs may not be able to charge its higher participants a good give more than the newest give anywhere between government and best money loans production.

Contained in this region we showcased a few of the latest improvements from inside the the brand new FHLB program. Area step 3 talks about brand new implications of those developments to own economic balances

step one. Authors: Stefan Gissler and Borghan Narajabad (R&S). We would like to thank Alice Moore and you can Erin Hart having the search direction, and you may Celso Brunetti, Draw Carlson, Burcu Duygan-Bump, Joshua Gallin, Diana Hancock, Lyle Kumasaka, Andreas Lehnert, Laura Lipscomb, Patrick McCabe, Michael Palumbo, John Schindler, and you will Way Teller to have of use comments and you can informative discussions. The fresh new viewpoints conveyed within paper try solely those of writers and do not fundamentally reflect brand new opinions of Board away from Governors of your own Government Put aside System otherwise their personnel. Return to text message

2. The fresh new structure of one’s harmony sheet differs across the FHLBs and this the new show of one’s securities collection are as an alternative small (instance getting FHLB Ny) or even more than simply one-third of your equilibrium layer (for example to possess FHLB Chi town). Come back to text

No Comments